What Does the Post Crash VC Market Look Like?

Both Sides of the Table

SEPTEMBER 15, 2022

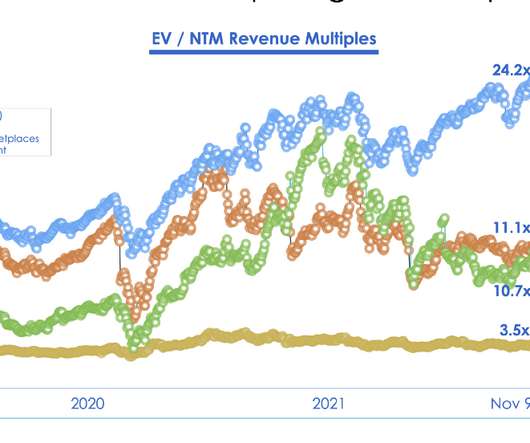

Should SaaS companies trade at a 24x Enterprise Value (EV) to Next Twelve Month (NTM) Revenue multiple as they did in November 2021? 40% of our deals are done in Los Angeles but 100% of our deals leverage the LA networks we have built for 25 years. We do deals in NYC, Paris, Seattle, Austin, San Francisco, London?—?but

Let's personalize your content