Playing the Long Game in Venture Capital

Both Sides of the Table

MAY 24, 2021

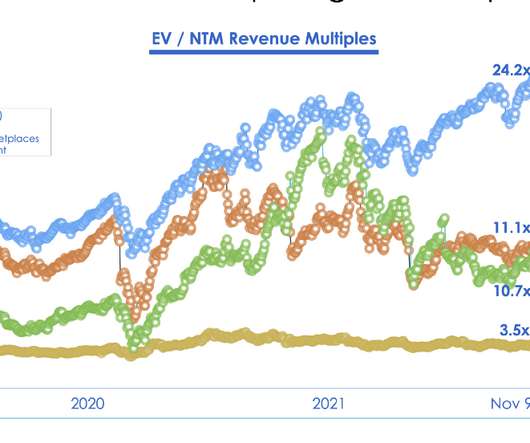

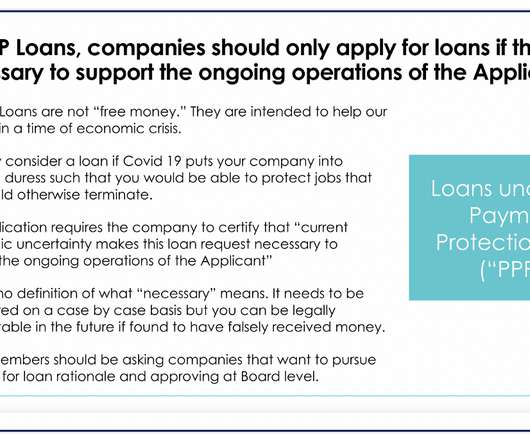

It has historically been the case that VCs would rather fund the promise of 100x in a company with almost no revenue than the reality of a company growing at 50% but doing $20+ million in sales. The abundance of late-stage capital is good for us all. My first ever investment as a VC was Invoca. Maker Studios?—?sold

Let's personalize your content