K1 Invests $21 Million in Eltropy

L.A. Business Journal

JUNE 16, 2021

Manhattan Beach-based private equity firm K1 Investment Management is making a $21 million investment in software company Eltropy Inc.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

L.A. Business Journal

JUNE 16, 2021

Manhattan Beach-based private equity firm K1 Investment Management is making a $21 million investment in software company Eltropy Inc.

Both Sides of the Table

NOVEMBER 29, 2014

This week I wrote about obsessive and competitive founders and how this forms the basis of what I look for when I invest. I had been thinking a lot about this recently because I’m often asked the question of “what I look for in an entrepreneur when I want to invest?” I had invested in myself for years.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Both Sides of the Table

SEPTEMBER 12, 2013

But as sweet as that success has been (we invested pre-revenue in a small team) today my even more important news was the further expansion of our partner ranks. It was a software platform for allowing advertisers to purchase brand integration (product placements) as a standardized unit through a marketplace. What does that mean?

socalTECH

OCTOBER 25, 2021

The company said the funding came from InReach Ventures and Taggia Investments, the personal investment vehicle of former Balderton Capital founder Barry Maloney. The company said its software moves technical data preparation tasks usually performed by IT to non-technical business users.

socalTECH

FEBRUARY 13, 2020

San Diego-based Seqster , which develops software used f[link] health data management, said today that it has received an investment from Takeda Pharmaceuticals. Size of the investment was not announced. Seqster is led by Ardy Arianpour. READ MORE>>.

socalTECH

DECEMBER 11, 2018

The firm said it is targeting initial investment of $5 million in companies generating revenue between $1 million and $5 million, and already has made investments in five companies, including Alpha, Broadly, Built Robotics, Embodied, and Soft Robotics. READ MORE>>.

socalTECH

MAY 6, 2019

Los Angeles-based AppOnboard says it has begun giving away its codeless app development software, AppOnboard Studio , to help developers create "instant apps" and playable ads, as well as prototypes. AppOnboard explains that many of its developer had previously only built apps for iOS. READ MORE>>.

socalTECH

NOVEMBER 21, 2019

Irvine-based SurePrep , a developer of tax automation software and services for the professional tax return preparation market, has received what it calls a "significant" minority growth investment. The investment came from private equity investor Bregal Sagemount. Size and details on the financing round were not announced.

socalTECH

NOVEMBER 18, 2019

Goleta-based AutoVitals , which develops software-as-a-service (SaaS) products for the automotive repair and maintenance software business, has raised a round of private equity, the company recently announced, from private equity investor Tritium Partners.

Both Sides of the Table

DECEMBER 7, 2014

I had dinner this week with a top new customer at one of our enterprise software investments. I wish I did more enterprise software investing because when I attend meetings like this I realize that this is my core DNA – rolling out business software solutions to customers. If not, somebody else will.

Both Sides of the Table

DECEMBER 12, 2016

Why Invest? Why Invest? Put simply Chuck is amongst the smartest and most knowledgeable leaders in the CRM industry and in the components I consider the future of enterprise software — voice driving input/output, chat-based computing and mobile-first design. Why Invest? The reason is simple.

Both Sides of the Table

JULY 26, 2022

We remain confident in the long-term trend that software enables and the value accrued to disruptive startups; we also recognized that in a strong market it is important to ring the cash register and this doesn’t come without a concentrated effort to do so. The answer is: not much.

Both Sides of the Table

MARCH 19, 2013

The era of VCs investing in successful consumer Internet startups such as eBay led to a belief system that seemed to permeate many enterprise software startups that hiring sales or implementation people was a bad thing. We only want software revenue.” We prefer to sell software, not get involved with client systems.”

socalTECH

NOVEMBER 18, 2021

San Diego-based Miva, which develops e-commerce software, said today that it has received a "significant equity investment" from growth equity investor Equality Asset Management. Financial details of the investment were not announced. According to the company, it will continue to be led by current CEO Rick Wilson.

socalTECH

MARCH 25, 2021

Torrance-based BQE said on Wednesday that it has received a "significant investment" from private equity investor Serent Capital. Financial details of the investment were not announced. Serent Capital is a private equity investor that invests in technology and tech-enabled software companies.

socalTECH

JULY 8, 2021

Los Angeles-based private equity investor Diversis Capital Partners has made a "significant" growth investment in Toronto-based Adlib, a developer of software used for structuring data. Size of that investment was not announced. Diversis invests in software and technology companies, investing in lower middle-market companies.

socalTECH

JUNE 10, 2021

Los Angeles-basd private equity investor K1 Investment Management has made a $120M investment in New York- and London-based >ComplySci, the two companies said this morning. ComplySci is a developer of regulatory and compliance software for the financial services sector.

socalTECH

FEBRUARY 24, 2021

Huntington Beach-based BeSmartee, a developer of digital mortgage software, said Tuesday that it has received a strategic growth investment. Size of the new investment was not announced. The funding came from M33 Growth.

socalTECH

APRIL 14, 2020

Los Angeles-based Q-CTRL , a company that is developing quantum computing and control technology, has received a strategic investment from In-Q-Tel (IQT), the investment arm of the U.S. intelligence community. Size of the funding was not announced. Size of the funding was not announced. intelligence agencies.

socalTECH

JULY 9, 2020

Los Angeles-based Synadia Communications , a software startup that is behind the open source NATS.io Size of the strategic investment was not announced. project, has raised a round of funding from Accenture , the two companies said today.

Both Sides of the Table

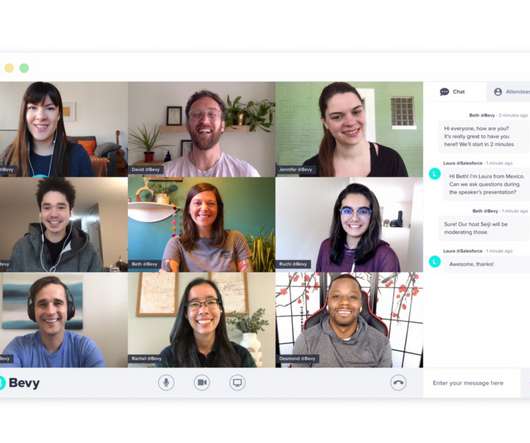

MAY 19, 2020

Bevy is Emerging as a Leader in Software for Building Virtual Communities?—?with they could invest in entrepreneurial communities and the best founders would then bring in new founders. Ryan Smith, the founder of Qualtrics, also invested and has joined the board of directors. It’s no wonder they’ve both performed so well.

socalTECH

JULY 16, 2021

5th Kind, a developer of workflow management software for Hollywood studios, has scored an investment from private equity investor HCAP Partners. Size of the investment was not announced. According to HCAP, the investment capital will go to fund growth initiatives for 5th Kind.

socalTECH

DECEMBER 31, 2018

Here's Alon Goren , founder of 805 Startups and the Crypto Invest Summit. Many of my friends made a killing (in the short-term) investing in these deals and because of the network that I have built with Crypto Invest Summit, I had access to most of them. You'll be able to browse all of those contributions here.

TechCrunch LA

MARCH 27, 2021

Who knew building a vertical software as a service toolkit focused on home heating and cooling could be worth $8.3 Rowe Price, Dragoneer Investment Group, and ICONIQ Growth. The company’s massive mint comes thanks to a new $500 million financing round led by Sequoia’s Global Equities fund and Tiger Global Management.

socalTECH

JULY 14, 2021

Los Angeles-based Endgame, a developer of software that links user behavior with sales opportunities, has raised $17M in funding, according to the company. The company said the funding will go to increase headcount, invest in R&D, and other efforts.

socalTECH

JANUARY 22, 2019

This morning's interview is with Kevin O'Connor , a longtime investor and serial entrepreneur, who is now running venture capital investment firm ScOp Venture Capital. Just this past September was a year with Amazon, when I left, and we started investing in September under the new name, ScOp Venture Capital.

socalTECH

OCTOBER 22, 2021

Los Angeles-based ChowNow, which develops software to manage online ordering and marketing for restaurants, has named a new CFO. Mancl was previously an investment banker, having previously been at Credit Suisse, where he served as the Global co-head of Internet Investment Banking.

socalTECH

MARCH 28, 2019

We spoke with Meredith Finn a new Partner at March Capital--who headed up that the Rise of the Female Entrepreneur sessions this year--to hear more about her perspectives on investments, what the Rise of the Female Entrepeneur was all about, March's interests in artificial intelligence and more. What's your role at March Capital?

socalTECH

JULY 7, 2021

Ventura-based advertising technology developer The Trade Desk is launching its own venture capital arm, and has made its first investment, the company said this morning. The company said that the new investment fund, TD7, will invest in open Internet startups.

socalTECH

OCTOBER 28, 2021

Los Angeles-based Skyryse, a startup which is developing software to automate piloting of aircraft, has raised $200M in a Series B funding round, according to the company. The company is working with Robinson Helicopters, along with four other aviation manufacturers, to developing pilot automation software for aircraft.

socalTECH

MARCH 12, 2021

For our Insights and Opinions section today, we have an article from Tony Cristiano of Pivotal Arc, talking about 3 Steps to Software Market Entry Success. There is much money to be made in software and tech. So, you want to leverage your software or tech offerings to expand in an adjacent market. Let us know!

TechCrunch LA

NOVEMBER 1, 2019

Software development companies tackling services for niche industries, like commercial real estate subcontracting, continue to find Los Angeles to be fertile ground for development. Software for the service industry is nothing new for Los Angeles entrepreneurs. Co-founded by former ServiceTitan devel. ”

socalTECH

JANUARY 26, 2021

ServiceNow, the digital workflow and service management software developer which has operations in San Diego, said today that it has launched a new $100M investment fund, part of which will look at investments in San Diego.

socalTECH

SEPTEMBER 16, 2019

According to the company, it offers up its software to cities and counties to help those counties and cities identify unpaid property taxes from real estate improvements done without plans and permits. The company said that the lead investor that participated in its first two rounds of seed funding was Loeb Enterprise.

socalTECH

APRIL 27, 2021

Los Angeles-based Guesty, a developer of property management software for the short-term rental market--including Airbnb, Booking.com, Agoda, Vrbo and TripAdvisor--has raised $50M in a Series D funding, the company announced this morning. The funding brings the company's total raised to $110M.

socalTECH

SEPTEMBER 21, 2021

Los Angeles-based e-commerce software developer Assembly has joined the ranks of the local unicorn startups, according to the company, after getting a "significant capital injection" from Advent International. The company did not say how much Advent International invested in the company.

Startup Professionals Musings

JANUARY 14, 2023

A software product is a classic example of a scalable solution, since it costs real money to build the first copy, but unlimited additional copies can be quickly cloned for almost no incremental cost. Investors don’t invest in services startups. These are more likely scalable and investable.

socalTECH

APRIL 24, 2020

Carey tells us a bit about what OC4 is doing, how it invests and works with companies, and also gives startups some advice about how to approach moving forward in light of the pandemic. Carey Ransom: The way I think about it, is it is really the culmination of almost two decades of software and technology company building and investing.

socalTECH

OCTOBER 27, 2020

Santa Barbara-based Theta Lake , a developer of security and compliance software which connects with Cisco Webex, Microsoft Teams, RingCentral, Zoom and other collaboration platforms, has raised $12.7M in a Series A funding.

TechCrunch LA

APRIL 27, 2021

Clio , a software company that helps law practices run more efficiently with its cloud-based technology, announced Tuesday it has raised a $110 million Series E round co-led by T. The investment also brings its total capital raised since its 2008 inception to $386 million. Rowe Price Associates Inc. and OMERS Growth Equity.

Both Sides of the Table

DECEMBER 27, 2011

You have to understand whether they’re likely to yield revenue growth in the near term OR whether you have access to cheap enough capital to fund your losses until your investments pay off. If you have a market lead then raising capital and making investments now will help you as others enter the market. ” The Details.

socalTECH

MARCH 16, 2017

Embark's website says it is focused on pre-seed and seed stage investments in Internet and software companies. Lee was previously at investor at Baroda Ventures, and Zhao was at ZMYX Global Investment, a Chinese equity investor. The firm has yet to announce any details of its funding. READ MORE>>.

socalTECH

JUNE 28, 2021

The company says it invests between $5M to $10M in early, growth-stage B2B software companies which are already generating $5M to $15M in recurring revenues. Ankona says its portfolio companies already include several companies, including Canopy, Cordial, GoSite, SOCi, VideoAmp, and Zingle.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content