Playing the Long Game in Venture Capital

Both Sides of the Table

MAY 24, 2021

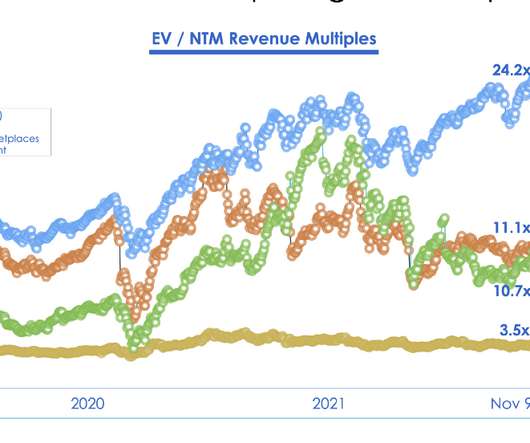

Of the first four investments I made as a VC in 2009, two have exited and two (Invoca & GumGum) still are independent and likely to produce $billion++ outcomes . The abundance of late-stage capital is good for us all. My first ever investment as a VC was Invoca. Entrada Ventures? —?that Maker Studios?—?sold

Let's personalize your content